Ohio state income tax rate 2021 information

Home » Trending » Ohio state income tax rate 2021 informationYour Ohio state income tax rate 2021 images are available. Ohio state income tax rate 2021 are a topic that is being searched for and liked by netizens today. You can Download the Ohio state income tax rate 2021 files here. Find and Download all royalty-free photos.

If you’re looking for ohio state income tax rate 2021 pictures information connected with to the ohio state income tax rate 2021 keyword, you have visit the right blog. Our site frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

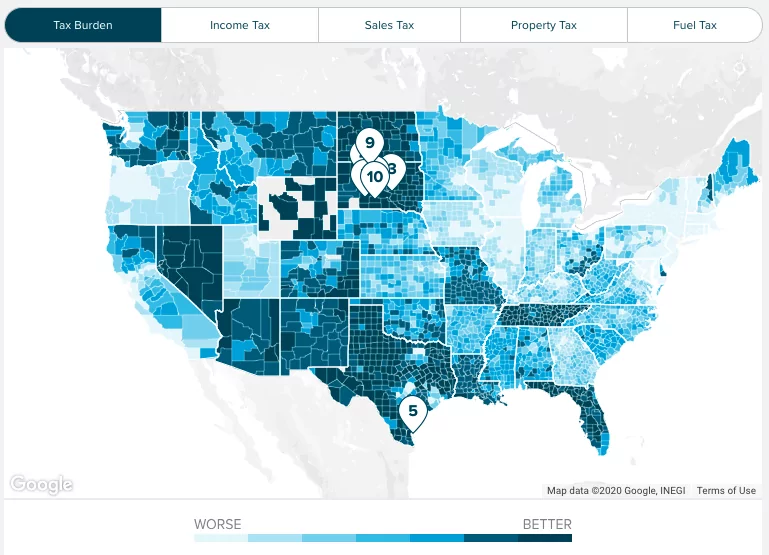

Ohio State Income Tax Rate 2021. For the 2020 tax year which you file in early 2021 the top rate is 4797. Starting in 2005 Ohios state income taxes saw a gradual decrease each year. Choose any state from the list above for detailed state income tax information including 2021 income tax tables state tax deductions and state-specific income tax calculators. This results in roughly of your earnings being taxed in total although depending on your situation there may be some other smaller taxes.

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep From itep.org

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep From itep.org

This results in roughly of your earnings being taxed in total although depending on your situation there may be some other smaller taxes. If you want to compare all of the state tax. Starting in 2005 Ohios state income taxes saw a gradual decrease each year. 22730 3247 of excess over 15000. Ad Ohio State Football Tickets. According to the Tax Foundation focusing on the Buckeye State ranks 20th among the states for state sales tax plus theres no state-level estate or inheritance tax.

Find The Best Deals On SeatGeek Ohio State Football Tickets.

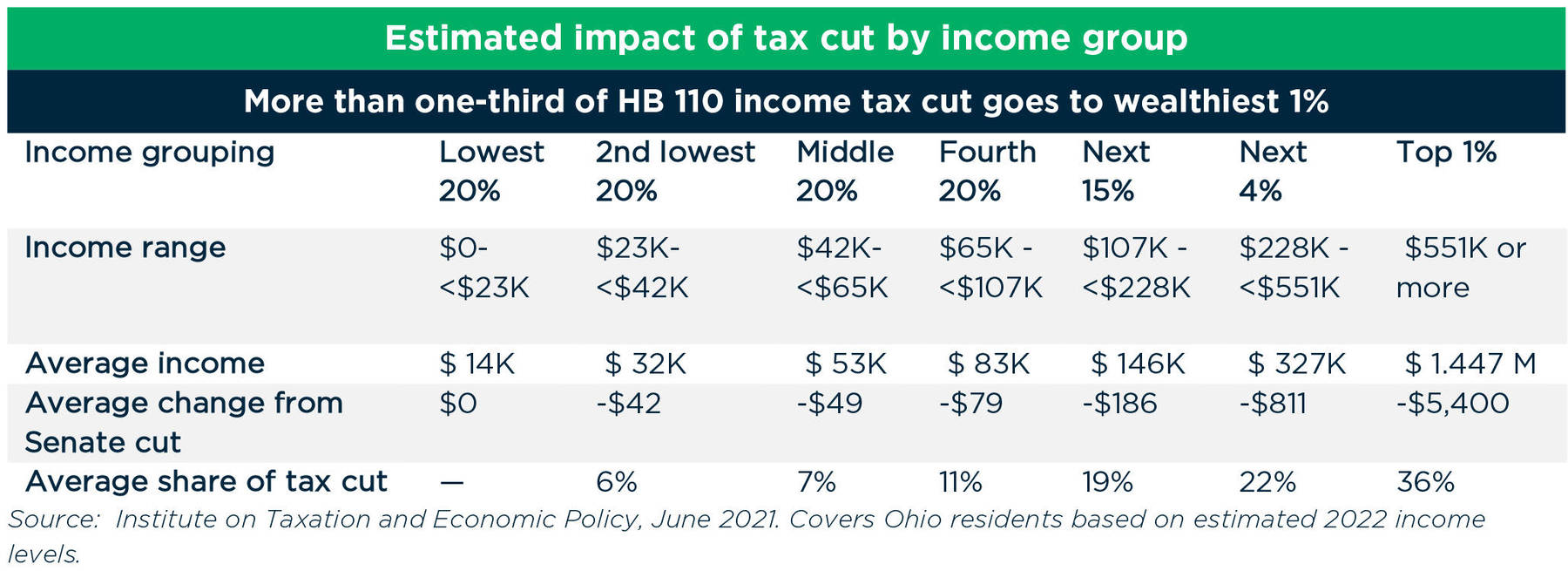

Starting in tax year 2021 the budget would scrap Ohios top personal income tax bracket with a rate of 4797 and cut the next-highest. According to the Tax Foundation focusing on the Buckeye State ranks 20th among the states for state sales tax plus theres no state-level estate or inheritance tax. Find The Best Deals On SeatGeek Ohio State Football Tickets. Starting in tax year 2021 the budget would scrap Ohios top personal income tax bracket with a rate of 4797 and cut the next-highest. Starting in 2005 Ohios state income taxes saw a gradual decrease each year. Moving forward anyone making less than 25000 will owe no income taxes in Ohio and all taxpayers will pay zero tax on their first 24999 in earnings.

Source: michaelkummer.com

Source: michaelkummer.com

All Ohio taxpayers will benefit from a 3 across-the-board reduction in income taxes. All Ohio taxpayers will benefit from a 3 across-the-board reduction in income taxes. Moving forward anyone making less than 25000 will owe no income taxes in Ohio and all taxpayers will pay zero tax on their first 24999 in earnings. Find The Best Deals On SeatGeek Ohio State Football Tickets. 22730 3247 of excess over 15000.

Source: pgpf.org

Source: pgpf.org

Ad Ohio State Football Tickets. Ohio Republicans have earned thanks from all taxpayers for passing this significant tax. According to the Tax Foundation focusing on the Buckeye State ranks 20th among the states for state sales tax plus theres no state-level estate or inheritance tax. Our calculator has recently been updated in order to include both the latest Federal Tax Rates along with the latest State Tax. If you want to compare all of the state tax.

Source: aarp.org

Source: aarp.org

Find The Best Deals On SeatGeek Ohio State Football Tickets. Many state pages also provide direct links to selected income tax return forms and other resources. Dec 04 2020 Ohio state income tax rate table for the 2020 - 2021 filing season has six income tax brackets with OH tax rates of 0 285 3326 3802 4413 and 4797. Ohio Republicans have earned thanks from all taxpayers for passing this significant tax. Ad Ohio State Football Tickets.

Source: cnet.com

Source: cnet.com

Ohio state income tax rate table for the 2020 - 2021 filing season has six income tax brackets with OH tax rates of 0 285 3326 3802 4413. 0649 of Ohio taxable income. Ad Ohio State Football Tickets. House Bill 110 134th General Assembly was signed into law on July 1 2021. Moving forward anyone making less than 25000 will owe no income taxes in Ohio and all taxpayers will pay zero tax on their first 24999 in earnings.

Source: hrblock.com

Source: hrblock.com

Starting in 2005 Ohios state income taxes saw a gradual decrease each year. 9740 2598 of excess over 10000. 22730 3247 of excess over 15000. The tables reflect a 30 reduction in the withholding rates previously in effect. According to the Tax Foundation focusing on the Buckeye State ranks 20th among the states for state sales tax plus theres no state-level estate or inheritance tax.

Source: smartasset.com

Source: smartasset.com

Ohio Republicans have earned thanks from all taxpayers for passing this significant tax. The tables reflect a 30 reduction in the withholding rates previously in effect. Find The Best Deals On SeatGeek Ohio State Football Tickets. Our calculator has recently been updated in order to include both the latest Federal Tax Rates along with the latest State Tax. Ohio state income tax rate table for the 2020 - 2021 filing season has six income tax brackets with OH tax rates of 0 285 3326 3802 4413.

Source: itep.org

Source: itep.org

Starting in tax year 2021 the budget would scrap Ohios top personal income tax bracket with a rate of 4797 and cut the next-highest. Ohio Salary Tax Calculator for the Tax Year 202122. Ad Ohio State Football Tickets. All Ohio taxpayers will benefit from a 3 across-the-board reduction in income taxes. 3245 1299 of excess of 5000.

Source: pinterest.com

Source: pinterest.com

Starting in tax year 2021 the budget would scrap Ohios top personal income tax bracket with a rate of 4797 and cut the next-highest. 9740 2598 of excess over 10000. Many state pages also provide direct links to selected income tax return forms and other resources. Ad Ohio State Football Tickets. All Ohio taxpayers will benefit from a 3 across-the-board reduction in income taxes.

Source: pinterest.com

Source: pinterest.com

9740 2598 of excess over 10000. While most states use a marginal bracketed income tax system similar to the federal income tax every state has a completely unique income tax code. - Ohio State Tax. Find The Best Deals On SeatGeek Ohio State Football Tickets. 38965 3895 of excess over 20000.

Source: taxfoundation.org

Source: taxfoundation.org

Starting in 2005 Ohios state income taxes saw a gradual decrease each year. Many state pages also provide direct links to selected income tax return forms and other resources. 9740 2598 of excess over 10000. While most states use a marginal bracketed income tax system similar to the federal income tax every state has a completely unique income tax code. According to the Tax Foundation focusing on the Buckeye State ranks 20th among the states for state sales tax plus theres no state-level estate or inheritance tax.

Source: policymattersohio.org

Source: policymattersohio.org

Moving forward anyone making less than 25000 will owe no income taxes in Ohio and all taxpayers will pay zero tax on their first 24999 in earnings. - Ohio State Tax. Starting in tax year 2021 the budget would scrap Ohios top personal income tax bracket with a rate of 4797 and cut the next-highest. Find The Best Deals On SeatGeek Ohio State Football Tickets. Ad Ohio State Football Tickets.

Source: putnam.com

Source: putnam.com

Find The Best Deals On SeatGeek Ohio State Football Tickets. If you want to compare all of the state tax. According to the Tax Foundation focusing on the Buckeye State ranks 20th among the states for state sales tax plus theres no state-level estate or inheritance tax. Ohio Income Tax Rate and OH Tax Brackets 2020 - 2021 Details. Ohio Republicans have earned thanks from all taxpayers for passing this significant tax.

Source: pinterest.com

Source: pinterest.com

Filing 2500000 of earnings will result in of your earnings being taxed as state tax calculation based on 2021 Ohio State Tax Tables. Ohio state income tax rate table for the 2020 - 2021 filing season has six income tax brackets with OH tax rates of 0 285 3326 3802 4413. Ad Ohio State Football Tickets. Starting in 2005 Ohios state income taxes saw a gradual decrease each year. Filing 2500000 of earnings will result in of your earnings being taxed as state tax calculation based on 2021 Ohio State Tax Tables.

Our calculator has recently been updated in order to include both the latest Federal Tax Rates along with the latest State Tax. 0649 of Ohio taxable income. Dec 04 2020 Ohio state income tax rate table for the 2020 - 2021 filing season has six income tax brackets with OH tax rates of 0 285 3326 3802 4413 and 4797. All Ohio taxpayers will benefit from a 3 across-the-board reduction in income taxes. Ohio can be hard to peg from a tax perspective.

Source: pinterest.com

Source: pinterest.com

If you want to compare all of the state tax. While most states use a marginal bracketed income tax system similar to the federal income tax every state has a completely unique income tax code. Find The Best Deals On SeatGeek Ohio State Football Tickets. Ohio state income tax rate table for the 2020 - 2021 filing season has six income tax brackets with OH tax rates of 0 285 3326 3802 4413. Find The Best Deals On SeatGeek Ohio State Football Tickets.

Source: house.leg.state.mn.us

Source: house.leg.state.mn.us

9740 2598 of excess over 10000. For the 2020 tax year which you file in early 2021 the top rate is 4797. - Ohio State Tax. Find The Best Deals On SeatGeek Ohio State Football Tickets. 0649 of Ohio taxable income.

Source: forbes.com

Source: forbes.com

While most states use a marginal bracketed income tax system similar to the federal income tax every state has a completely unique income tax code. Ohio can be hard to peg from a tax perspective. You are able to use our Ohio State Tax Calculator in to calculate your total tax costs in the tax year 202122. Find The Best Deals On SeatGeek Ohio State Football Tickets. Ohio Income Tax Rate and OH Tax Brackets 2020 - 2021 Details.

Source: chadpeshke.com

Source: chadpeshke.com

Our calculator has recently been updated in order to include both the latest Federal Tax Rates along with the latest State Tax. While most states use a marginal bracketed income tax system similar to the federal income tax every state has a completely unique income tax code. 9740 2598 of excess over 10000. House Bill 110 134th General Assembly was signed into law on July 1 2021. Ad Ohio State Football Tickets.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ohio state income tax rate 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Ecu football entrance song information

- Texas arlington vs arkansas state information

- Tennessee football vaccination rate information

- Notre dame football in chicago information

- Iowa vs iowa state over under information

- Notre dame toledo football information

- Pitt football parking map information

- Ohio state football outlook 2021 information

- Psg vs clermont foot results information

- Utah football games 2021 information