Ohio state income tax rate information

Home » Trend » Ohio state income tax rate informationYour Ohio state income tax rate images are ready. Ohio state income tax rate are a topic that is being searched for and liked by netizens now. You can Download the Ohio state income tax rate files here. Find and Download all royalty-free photos.

If you’re searching for ohio state income tax rate images information connected with to the ohio state income tax rate keyword, you have come to the ideal blog. Our website always gives you hints for seeking the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

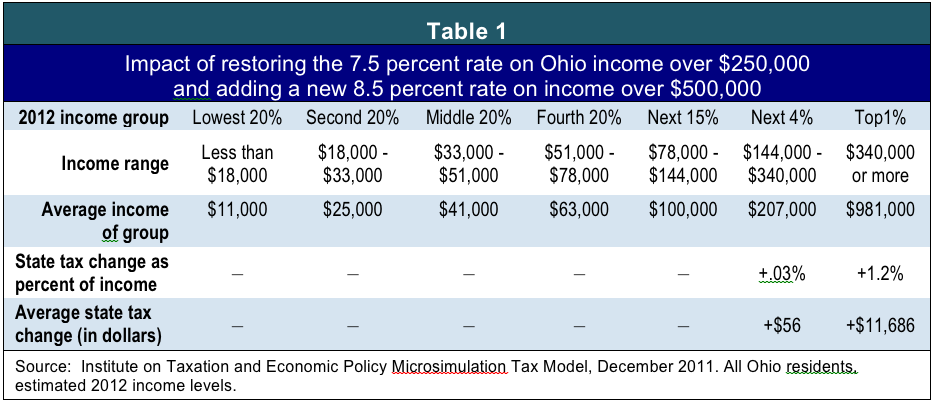

Ohio State Income Tax Rate. The Ohio Senate had proposed income tax cuts of 5 percent and the Ohio House had proposed income tax cuts of 2 percent. Ad Search for State Tax Lawyer information. Ohio collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Ohio has five marginal tax brackets ranging from 285 the lowest Ohio tax bracket to 48 the highest Ohio tax bracket.

Ohio Income Tax Updates Bradstreet Cpas Tax Tip Of The Week From bradstreetcpas.com

Ohio Income Tax Updates Bradstreet Cpas Tax Tip Of The Week From bradstreetcpas.com

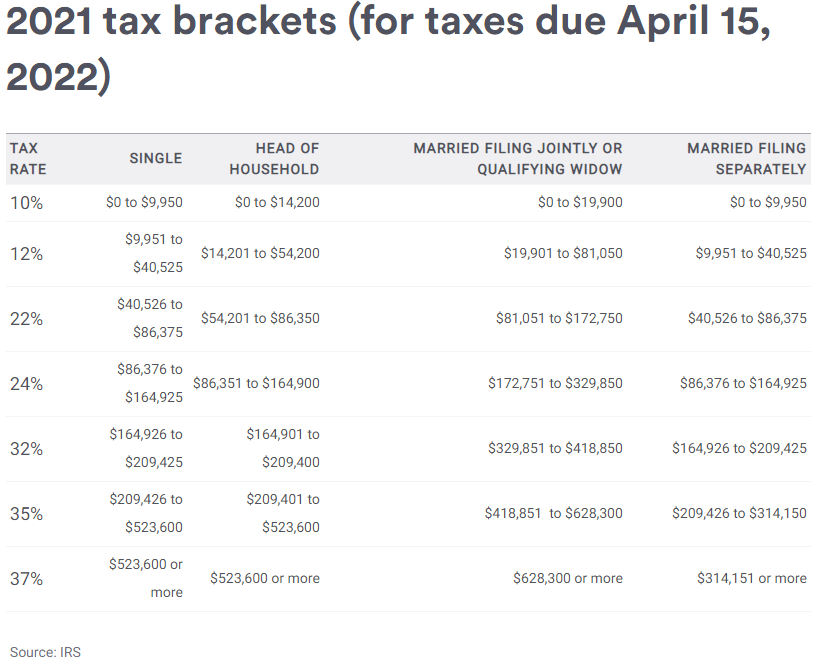

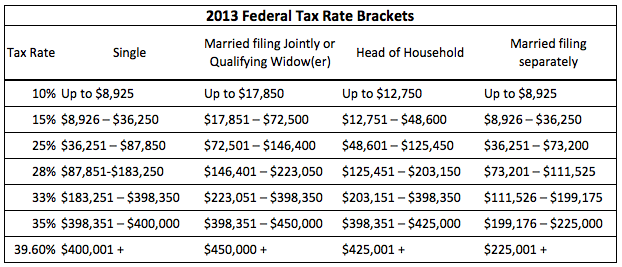

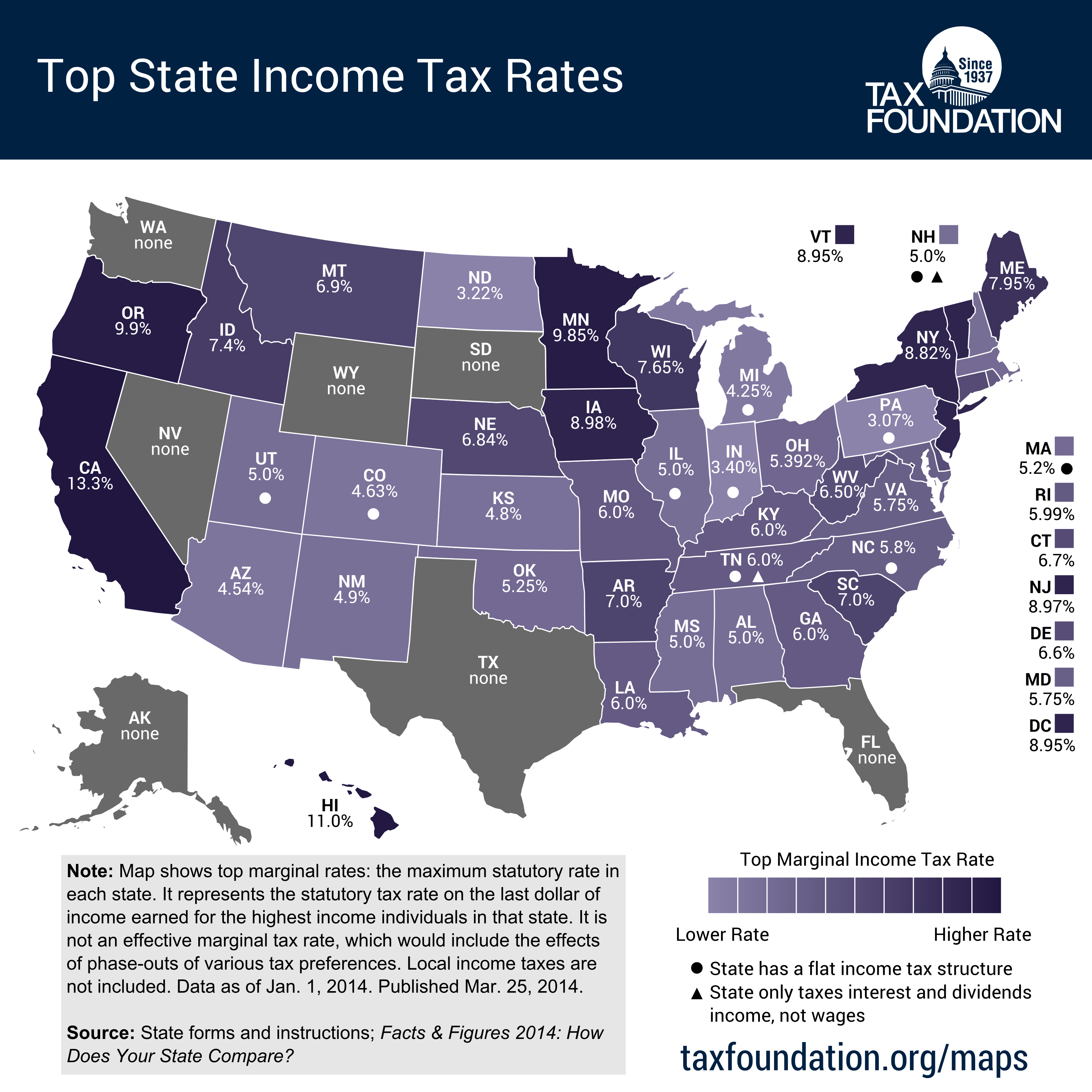

While the state rate is relatively low compared to other states with an income tax many Ohio municipalities charge an additional. After a few seconds you will be. The following are the Ohio individual income tax tables for 2005 through 2020. Ad Search for State Tax Lawyer information. Overall state tax rates range from 0 to more than 13 as of 2021. State income taxes which vary by state are a percentage of your earned or unearned income that you pay to the state government.

The following are the Ohio individual income tax tables for 2005 through 2020.

Overall state tax rates range from 0 to more than 13 as of 2021. The following are the Ohio individual income tax tables for 2005 through 2020. Ohio Income Tax Rate and OH Tax Brackets 2020 - 2021 Details. State income taxes which vary by state are a percentage of your earned or unearned income that you pay to the state government. The final biennial budget in Ohio includes a 16 billion reduction in the state income tax the biggest income tax cut in a two-year budget in state. To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Ohio has five marginal tax brackets ranging from 285 the lowest Ohio tax bracket to 48 the highest Ohio tax bracket. Each states tax code is a multifaceted system with many moving parts and Ohio is no exception. Location is everything if you want to save a few income tax dollars. Tax Bracket gross taxable income Tax Rate 0. To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Source: joecunninghampc.com

Source: joecunninghampc.com

For single taxpayers living and working in the state of Ohio. Ad Search for State Tax Lawyer information. The rate is at least 35 percent. Tax rate of 285 on taxable. 10 -Ohio Corporate Income Tax Brackets.

Source: hrblock.com

Source: hrblock.com

Unlike the Federal Income Tax Ohios state income tax. Ad Search for State Tax Lawyer information. State income taxes which vary by state are a percentage of your earned or unearned income that you pay to the state government. Ohio has a progressive income tax. Ad Search for State Tax Lawyer information.

Source: taxfoundation.org

Source: taxfoundation.org

The first step towards understanding Ohios. Ohio Administrative Code 5703-7-10 provides that withholding agents must withhold at least 35 on supplemental. The final biennial budget in Ohio includes a 16 billion reduction in the state income tax the biggest income tax cut in a two-year budget in state. For single taxpayers living and working in the state of Ohio. The following are the Ohio individual income tax tables for 2005 through 2020.

Source: nerdwallet.com

Source: nerdwallet.com

The Ohio Senate had proposed income tax cuts of 5 percent and the Ohio House had proposed income tax cuts of 2 percent. Ohio has no corporate income tax at the state. Location is everything if you want to save a few income tax dollars. Tax rate of 285 on taxable. Ohio has a progressive income tax.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

10 -Ohio Corporate Income Tax Brackets. Ad Search for State Tax Lawyer information. For single taxpayers living and working in the state of Ohio. 10 -Ohio Corporate Income Tax Brackets. Ohio Income Tax Rate and OH Tax Brackets 2020 - 2021 Details.

10 -Ohio Corporate Income Tax Brackets. Dec 04 2020 Ohio state income tax rate table for the 2020 - 2021 filing season has six. Filing 24000000 of earnings will result in of your earnings being taxed as state tax calculation based on 2021 Ohio State Tax. 2021 Ohio Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Ohio has a progressive income tax.

Source: itep.org

Source: itep.org

Ohio has five marginal tax brackets ranging from 285 the lowest Ohio tax bracket to 48 the highest Ohio tax bracket. For single taxpayers living and working in the state of Ohio. Ohio has five marginal tax brackets ranging from 285 the lowest Ohio tax bracket to 48 the highest Ohio tax bracket. The following are the Ohio individual income tax tables for 2005 through 2020. After a few seconds you will be.

Source: urban.org

Source: urban.org

To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Tax rate of 285 on taxable. 10 -Ohio Corporate Income Tax Brackets. - Ohio State Tax. To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Source: bradstreetcpas.com

Source: bradstreetcpas.com

Ohio has no corporate income tax at the state. - Ohio State Tax. The rate is at least 35 percent. 2021 Ohio Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Filing 24000000 of earnings will result in of your earnings being taxed as state tax calculation based on 2021 Ohio State Tax.

Ohio Administrative Code 5703-7-10 provides that withholding agents must withhold at least 35 on supplemental. Tax rate of 285 on taxable. Overall state tax rates range from 0 to more than 13 as of 2021. Dec 04 2020 Ohio state income tax rate table for the 2020 - 2021 filing season has six. Ohio has a progressive income tax.

Source: businessplanninggroup.com

Source: businessplanninggroup.com

10 -Ohio Corporate Income Tax Brackets. Overall state tax rates range from 0 to more than 13 as of 2021. Tax rate of 0 on the first 22150 of taxable income. 2021 Ohio Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Tax Bracket gross taxable income Tax Rate 0.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Ohio has no corporate income tax at the state. Each marginal rate only. Please note that as of 2016 taxable business income is taxed at a flat rate of 3. The Ohio Senate had proposed income tax cuts of 5 percent and the Ohio House had proposed income tax cuts of 2 percent. 2021 Ohio Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

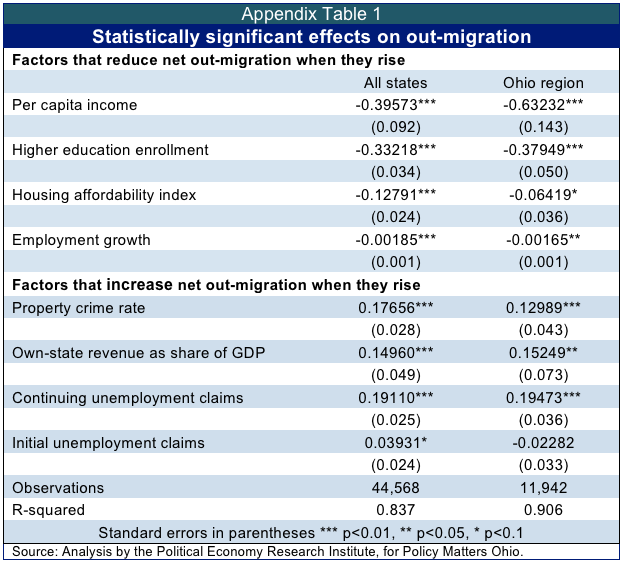

Source: policymattersohio.org

Source: policymattersohio.org

The first step towards understanding Ohios. While the state rate is relatively low compared to other states with an income tax many Ohio municipalities charge an additional. Ohio has a progressive income tax. Ohio Administrative Code 5703-7-10 provides that withholding agents must withhold at least 35 on supplemental. Each marginal rate only.

Source: incometaxpro.net

Source: incometaxpro.net

Filing 24000000 of earnings will result in of your earnings being taxed as state tax calculation based on 2021 Ohio State Tax. Ohio has a progressive income tax. Location is everything if you want to save a few income tax dollars. To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Ad Search for State Tax Lawyer information.

Source: crainscleveland.com

Source: crainscleveland.com

The first step towards understanding Ohios. Each states tax code is a multifaceted system with many moving parts and Ohio is no exception. The rate is at least 35 percent. Ohio has a progressive income tax. Ohio collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Source: joecunninghampc.com

Source: joecunninghampc.com

- Ohio State Tax. Location is everything if you want to save a few income tax dollars. To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The Ohio Senate had proposed income tax cuts of 5 percent and the Ohio House had proposed income tax cuts of 2 percent. The final biennial budget in Ohio includes a 16 billion reduction in the state income tax the biggest income tax cut in a two-year budget in state.

Source: itep.org

Source: itep.org

Ad Search for State Tax Lawyer information. Ohio has a progressive income tax. The final biennial budget in Ohio includes a 16 billion reduction in the state income tax the biggest income tax cut in a two-year budget in state. Each states tax code is a multifaceted system with many moving parts and Ohio is no exception. The first step towards understanding Ohios.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ohio state income tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Colorado state football jersey information

- Washington huskies football jacket information

- South carolina football facility information

- Mercer university football division information

- Chelsea vs aston villa line up today information

- Fsu football box seats information

- Deion sanders offensive stats information

- Jackson state football highlights information

- Jacksonville state university football game today information

- Ohio state football score today information